Car title loan equity requirements hinge on assessing your vehicle's value minus existing debt to secure financing. Lenders conduct thorough credit checks and evaluate risk for recovery in case of default, unlike traditional loans that offer more rigid payment structures. Vehicle modifications impact loan terms, with substantial alterations potentially leading to stricter criteria and higher interest rates. Minor upgrades have less effect, allowing for quicker cash access and flexible repayment options. Documenting modifications, performing regular maintenance, and demonstrating responsible ownership can help secure favorable car title loan equity requirements.

Vehicle modifications can significantly impact your car title loan equity, affecting both loan terms and interest rates. This article delves into the intricate relationship between modifying your vehicle and the equity you hold in your car title loan. We’ll explore how changes to your vehicle’s value, either through enhancements or repairs, influence your loan-to-value ratio. Additionally, we provide strategies for borrowers to navigate post-modification Car title Loan Equity Requirements, ensuring you stay informed and in control of your financial decisions.

- Understanding Car Title Loan Equity: The Basics

- Impact of Vehicle Modifications on Loan Terms and Rates

- Meeting Title Loan Equity Requirements After Mods: Strategies for Borrowers

Understanding Car Title Loan Equity: The Basics

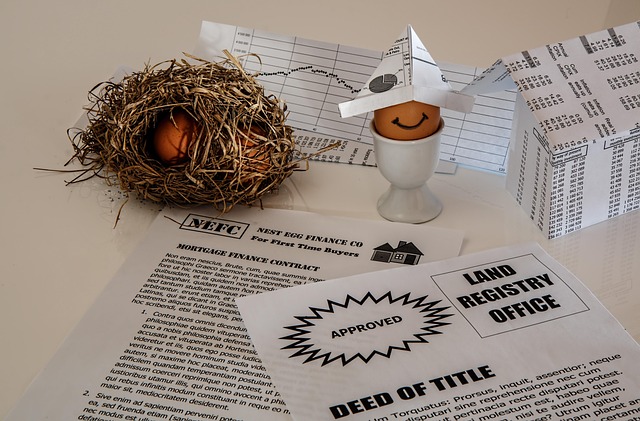

Car title loan equity refers to the value or worth of your vehicle as determined by a lender during the loan process. It’s essentially what your car is worth, minus any outstanding debt on it. This equity plays a significant role in securing a loan against your vehicle. Lenders use these requirements to assess risk and ensure they can recover the money loaned if you default.

The title loan process involves a thorough credit check to evaluate your financial health and determine your eligibility for a loan. Unlike traditional loans, car title loans offer flexible payments, allowing borrowers to manage their repayments based on their financial capabilities. Understanding car title loan equity requirements is crucial before diving into this alternative financing option.

Impact of Vehicle Modifications on Loan Terms and Rates

When it comes to vehicle modifications, lenders need to balance the potential increase in car title loan equity with the associated risks. While custom parts and upgrades can enhance a vehicle’s value, they may also complicate the lending process. Lenders carefully consider the impact of these modifications on loan terms and rates. Substantial alterations that significantly improve a vehicle’s performance or aesthetics might lead to stricter borrowing criteria, including higher interest rates. This is because the lender wants to ensure they retain their investment in case the borrower defaults.

Modifications like engine overhauls or extensive interior upgrades could signal increased maintenance costs, which lenders may factor into their risk assessment. As a result, loan terms might be shorter, and flexible payments might not be as readily available. In contrast, relatively minor changes such as new tires or a sound system upgrade may have less impact on loan equity requirements, allowing borrowers to access faster cash with more flexible repayment options, including semi-truck loans for those with specialized needs.

Meeting Title Loan Equity Requirements After Mods: Strategies for Borrowers

After making vehicle modifications, borrowers often wonder how it might affect their ability to secure a car title loan. It’s crucial to understand that lenders will assess the value and condition of your vehicle, including any alterations, when determining loan terms and equity. Fortunately, there are strategies to help meet the car title loan equity requirements even after modifying your ride. One approach is to ensure comprehensive documentation of all modifications, including costs and potential increase in resale value. This information can be used to argue for a higher loan-to-value ratio.

Additionally, keeping up with regular maintenance and repairs demonstrates responsible vehicle ownership, which can influence favorable loan terms. For those in Dallas considering a same day funding car title loan after modifications, being transparent about changes made to the vehicle is key. Lenders may offer tailored solutions or flexible loan options that accommodate specific circumstances, ensuring borrowers can access the funds they need without compromising their modified vehicle’s equity.

Vehicle modifications can significantly impact your car title loan equity, affecting both loan terms and interest rates. Understanding how these changes influence your debt obligations is crucial for borrowers looking to modify their vehicles while maintaining optimal loan conditions. By adhering to the updated car title loan equity requirements and implementing strategic financial decisions, borrowers can navigate these changes smoothly and continue to access affordable financing for their modified vehicles.