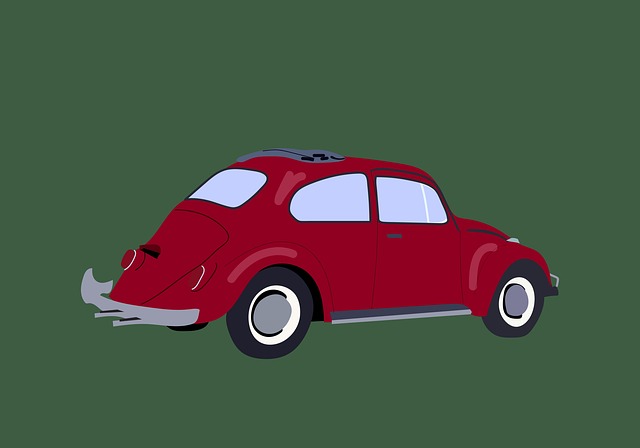

Car title loan equity requirements demand borrowers own their vehicles with no existing loans, aiming for a 50% minimum equity threshold. Maintaining vehicle value through proper maintenance and keeping detailed records aids in securing favorable terms. Alternative financial solutions exist but require thorough research. Lenders offer flexible options to meet strict car title loan equity requirements, ensuring swift approvals with transparent terms.

Meet your car title loan equity requirements with confidence! This guide unveils powerful strategies to ensure you maximize your vehicle’s equitable value. From understanding the fundamentals of car title loan equity to navigating potential challenges, this comprehensive resource equips borrowers with the knowledge to make informed decisions. Discover proven tactics to optimize your collateral’s worth and secure a favorable loan agreement.

- Understanding Car Title Loan Equity Requirements

- Strategies to Maximize Your Vehicle's Equitable Value

- Navigating Equity Challenges for Car Title Loans

Understanding Car Title Loan Equity Requirements

When considering a car title loan, understanding the equity requirements is paramount to ensuring a smooth title loan process. Lenders require borrowers to own their vehicle outright, with no outstanding loans or leases on it, as this serves as collateral for the loan. This means that if you’re seeking financial assistance, your vehicle must have enough equity—the difference between its value and any existing debt—to cover the loan amount.

The specific car title loan equity requirements vary from lender to lender. However, they generally look for a minimum equity threshold of 50% of the vehicle’s value. This ensures that the lender has a substantial security interest in the asset. An added advantage is that with an online application process, you can easily determine your vehicle’s equity and explore options for title loan equity requirements tailored to your needs.

Strategies to Maximize Your Vehicle's Equitable Value

Maximizing the equitable value of your vehicle is a key strategy to meet car title loan equity requirements. This involves ensuring that your vehicle’s current market value aligns with or exceeds the loan amount you’re seeking. One effective method is to maintain proper maintenance and upkeep, including regular servicing and necessary repairs. A well-cared-for vehicle not only looks more appealing to potential lenders but also retains its value better over time. Additionally, keeping detailed records of service histories and ownership can strengthen your application and increase the likelihood of securing favorable loan terms.

Consider alternative financial solutions like semi truck loans or bad credit loans if traditional car title loan options prove challenging. These specialized financing options cater to unique circumstances and may offer more flexible equity requirements compared to conventional car title loans. However, it’s crucial to thoroughly research and compare rates, terms, and conditions from various lenders to make an informed decision that aligns with your financial goals and capabilities.

Navigating Equity Challenges for Car Title Loans

Navigating the equity landscape for car title loans involves addressing specific challenges that are unique to this lending segment. One of the primary hurdles is ensuring sufficient equity in the vehicle, as lenders require a certain percentage of ownership to mitigate risk. Car owners often seek financial assistance to meet these equity requirements, especially when unexpected expenses arise. Lenders can facilitate this by offering flexible terms and options tailored to help borrowers maintain their vehicles while accessing needed funds.

Additionally, the speed at which a car title loan can be approved is a significant advantage that appeals to many borrowers. Quick approval processes enable individuals to access financial assistance promptly, allowing them to address immediate needs or unexpected emergencies without delay. This accessibility, coupled with transparent terms and conditions, can help borrowers navigate equity challenges more effectively, ensuring a positive lending experience.

Meeting car title loan equity requirements doesn’t have to be a challenging hurdle. By understanding these requirements, implementing strategies to maximize your vehicle’s equitable value, and proactively addressing potential challenges, you can secure the best terms for your car title loan. Stay informed, stay proactive, and unlock access to the capital you need while maintaining ownership of your vehicle.