Car title loan equity requirements involve lenders assessing vehicle value and borrower creditworthiness for secure financing. Declining equity impacts loan terms, with stricter conditions or repossession risk. Repayment defaults lower future equity, requiring negotiation or emergency funds to avoid asset loss. Some lenders offer non-credit check options for access during crises.

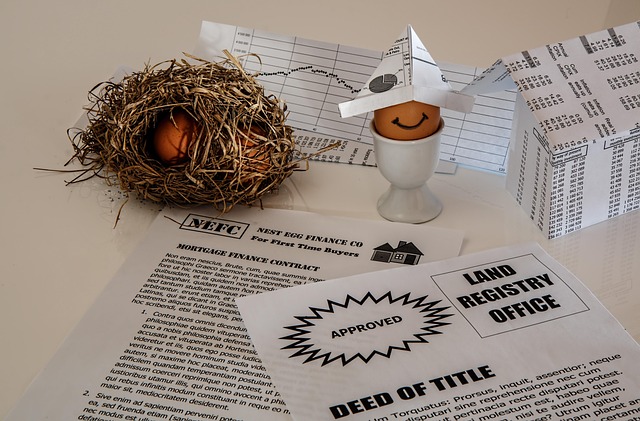

“When you take out a car title loan, understanding the associated equity is crucial. This article delves into the intricacies of car title loan equity requirements and what unfolds when said equity drops. We explore the potential scenarios, consequences, and recovery options available to borrowers. By grasping these dynamics, individuals can navigate such situations more effectively, ensuring they maintain control over their assets and financial stability.”

- Understanding Car Title Loan Equity

- What Happens When Equity Falls?

- Consequences and Recovery Options

Understanding Car Title Loan Equity

When considering a car title loan, understanding the equity requirements is crucial for determining your loan eligibility. Car title loans are secured by the vehicle’s ownership—the lender uses the car as collateral to ensure repayment. To establish equity, borrowers must meet specific criteria, typically involving a comprehensive credit check. This process assesses both the value of the vehicle and the borrower’s financial health.

The lender will evaluate the car’s market value, age, condition, and remaining loan balance (if any) on the title to determine the available equity. In many cases, a significant portion of the car’s value can be borrowed against, provided the borrower meets the necessary criteria for creditworthiness. This ensures that both parties—lender and borrower—are protected within the terms of the Car Title Loans agreement.

What Happens When Equity Falls?

When equity drops after a car title loan, several outcomes can ensue, directly impacting the borrower’s financial standing and the lender’s position. The primary concern is that as the value of the vehicle collateral decreases, so does the lender’s security. This means if the borrower defaults on repayments, recovering the outstanding debt becomes more challenging. Lenders typically assess the vehicle’s equity to determine the loan-to-value ratio, which is a crucial factor in approving and managing secured loans like car title loans.

A fall in equity might prompt lenders to reevaluate their terms, potentially leading to loan extension or modification scenarios. In some cases, borrowers may be required to pay off the remaining balance in full or face repossession of their vehicle collateral. It’s important for borrowers to understand that while these loans offer quicker access to cash using their vehicle as security, declining equity can make it harder to maintain control over their asset and repayment terms, emphasizing the need for careful financial planning throughout the loan process.

Consequences and Recovery Options

If a borrower fails to meet the agreed-upon repayment terms for a car title loan, the primary consequence is a drop in equity requirements. This can be detrimental as it limits the borrower’s access to future liquidity from their vehicle. The lender may repossess the vehicle, significantly reducing its resale value and further decreasing the owner’s equity.

However, borrowers facing this situation aren’t without options. Repayment plans can be negotiated with the lender to bring the loan current. Many lenders offer flexible repayment terms and even allow for partial payments to avoid repossession. Additionally, building emergency funds can help prevent future equity drops by providing a buffer for unforeseen expenses, making it easier to meet financial obligations. For those who qualify, there might be options available without a credit check, ensuring access to capital during challenging times.

When considering a car title loan, understanding the potential impact of declining equity is paramount. If the value of your vehicle drops post-loan, it can lead to reduced borrowing power and increased financial strain. However, there are recovery options available, such as repaying the loan in full or renegotiating terms with lenders who specialise in these situations. By staying informed about car title loan equity requirements and being proactive, borrowers can navigate these challenges and maintain control over their financial future.