Car title loans offer quick cash using vehicle equity as collateral, with lenders assessing vehicle value and condition to determine loan amounts. Credit score isn't primary; borrowers retain vehicle possession, enjoy flexible repayment options, and can refinance for lower rates. Understanding car title loan equity requirements is crucial for accessing this funding method, with lenders evaluating vehicle make, model, year, condition, mileage, and outstanding debts to establish equity. Good vehicle condition enhances eligibility, impacting loan amount and terms. Lenders balance fast requests with risk assessment, considering income, employment, and financial obligations for manageable monthly payments.

“Thinking about securing a loan using your vehicle’s equity? Discover how car title loans work and what factors determine approval. In this guide, we’ll break down the basics of these short-term loans, focusing on how the value of your vehicle’s equity plays a crucial role in the approval process. Learn about the key considerations lenders use to assess your application, ensuring you’re informed before making a decision.”

- Understanding Car Title Loan Basics

- Evaluating Vehicle Equity Requirements

- Factors Influencing Approval Decisions

Understanding Car Title Loan Basics

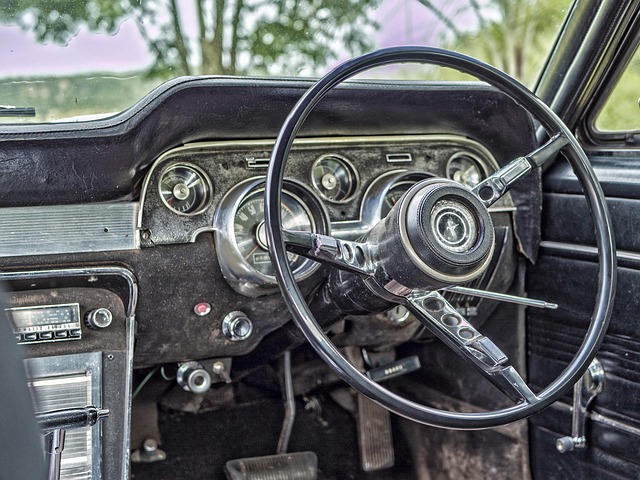

Car title loans are a type of secured lending that uses your vehicle’s equity as collateral. It’s a quick way to access cash, especially for those who need funds urgently. The process involves borrowing money from a lender by offering your car title as security. Unlike traditional loans where your credit score plays a significant role, car title loans focus on the value of your vehicle. Lenders assess the market value and condition of your car to determine its equity, which then sets the loan amount you can borrow.

Understanding the car title loan process is crucial. After applying and providing necessary documents, the lender will appraise your vehicle. If approved, they’ll issue a loan based on the established equity. One key advantage is that borrowers often retain possession of their vehicles throughout the loan term, unlike with traditional pawn or secured loans that may require surrendering the asset. Additionally, car title loans can offer flexible repayment terms, and if you choose to refinance your existing loan, it could potentially reduce your interest rates and monthly payments.

Evaluating Vehicle Equity Requirements

When applying for a car title loan, understanding the equity requirements is key to determining your loan eligibility. Lenders assess the value of your vehicle as collateral, ensuring they have security for the loan amount. The evaluation process involves considering factors such as the overall condition and make-year of the vehicle, mileage, and any existing loans or liens on the car. This ensures that the lender’s interest is protected and offers borrowers a clear path to access emergency funds if needed.

The equity required in a car title loan varies across lenders, but it typically depends on the vehicle’s current market value minus any outstanding debts associated with it. Borrowers can improve their loan eligibility by maintaining good vehicle condition and ensuring there are no major repairs or damage that could depreciate its worth. Understanding these equity requirements is crucial when exploring repayment options, as it directly impacts the loan amount you may qualify for and the overall terms of your borrowing agreement.

Factors Influencing Approval Decisions

When applying for a car title loan, several factors play a significant role in influencing approval decisions. One of the most crucial aspects is the equity value of your vehicle. Lenders assess this by conducting a thorough vehicle inspection to determine the market worth of your car. The make, model, year, condition, and overall mileage are key elements considered during this process. In addition to vehicle equity requirements, lenders also perform a credit check to evaluate your financial health and repayment capacity. A strong credit history can increase your chances of approval, while significant negative items may hinder it.

Fast cash is often a primary goal for those seeking car title loans, but lenders must balance this need with risk assessment. They carefully weigh the potential revenue from the loan against the likelihood of repayment. This includes evaluating your income, employment status, and overall financial obligations. Lenders aim to ensure that you can afford the monthly payments without causing a strain on your finances, thereby facilitating a smooth borrowing experience and fostering long-term client relationships.

When it comes to securing a car title loan, understanding the role of vehicle equity value is key. By evaluating the equity requirements and considering various approval factors, borrowers can navigate the process with confidence. Remember, the car title loan equity value is a significant determinant in ensuring access to much-needed funds quickly.